The Australian Bureau of Statistics has revealed personal fraud and scams are increasing for the second year in a row.

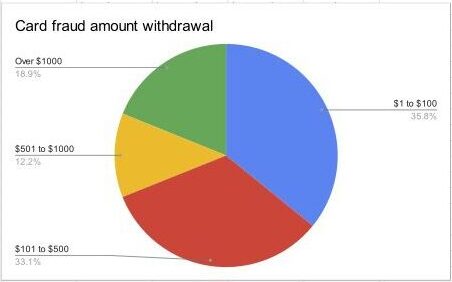

Card fraud involves the use of credit, debit or EFTPOS card details to make purchases or withdrawals without the account owner’s permission.

An estimated 8.7% of Australians experienced card fraud between 2022-2023.

Source: The Australian Bureau of Statistics

Australian banks and financial institutions are not legally obliged to refund money lost to scams or fraud, essentially placing responsibility back on the consumer.

Victim of card fraud, Maya Willows, 20, feels the banks should be obliged to protect their customers.

After alerting her bank that she would be travelling overseas, she noticed seven transactions, each $11.99, withdrawn from her account.

“I freaked out because I was overseas in the Philippines and couldn’t call to cancel my card or do it within the app because I was using a different phone number,” Ms Willows said.

Source: The Australian Bureau of Statistics

The Australian Bureau of Statistics fraud report found that the total gross amount lost to fraud was $2.2 billion, with the most common withdrawals totalling up to $100.

“I was missing $300 and they didn’t find it suspicious or anything that it came out in increments of $11.99 and then $14.99. I felt like my money was just there for the taking, I had to tell them about it,” Ms Willows said.

Source: The Australian Bureau of Statistics

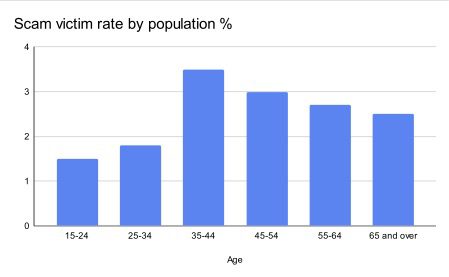

The Australian Bureau of Statistics also found that scams had affected an estimated 514,000 people.

However, the actual number of scam victims is thought to be much higher as many feel they don’t have sufficient evidence to be able to report.

In February 2024, Crystelle Gangi, 21, was scammed on Facebook Marketplace.

“I was a little hesitant because I had never bought anything off there before, the only second-hand stuff I buy is like clothes off Depop,” Ms Gangi said.

“I paid her, then when I got home the iPhone was kinda slow and the software looked different.

“I took it to Apple and straight away they were like we are so sorry that’s a fake iPhone. No one could do anything about it.”

Like fraud, scams have increased over the past two years, particularly on buying and selling platforms which are used by 25 to 44 year olds.

Despite card fraud and scams increasing, banks’ approaches to determining liability will likely keep the responsibility on the individual.

For now, advice from banks and selling sites like Facebook Marketplace is for the consumer to keep alert.