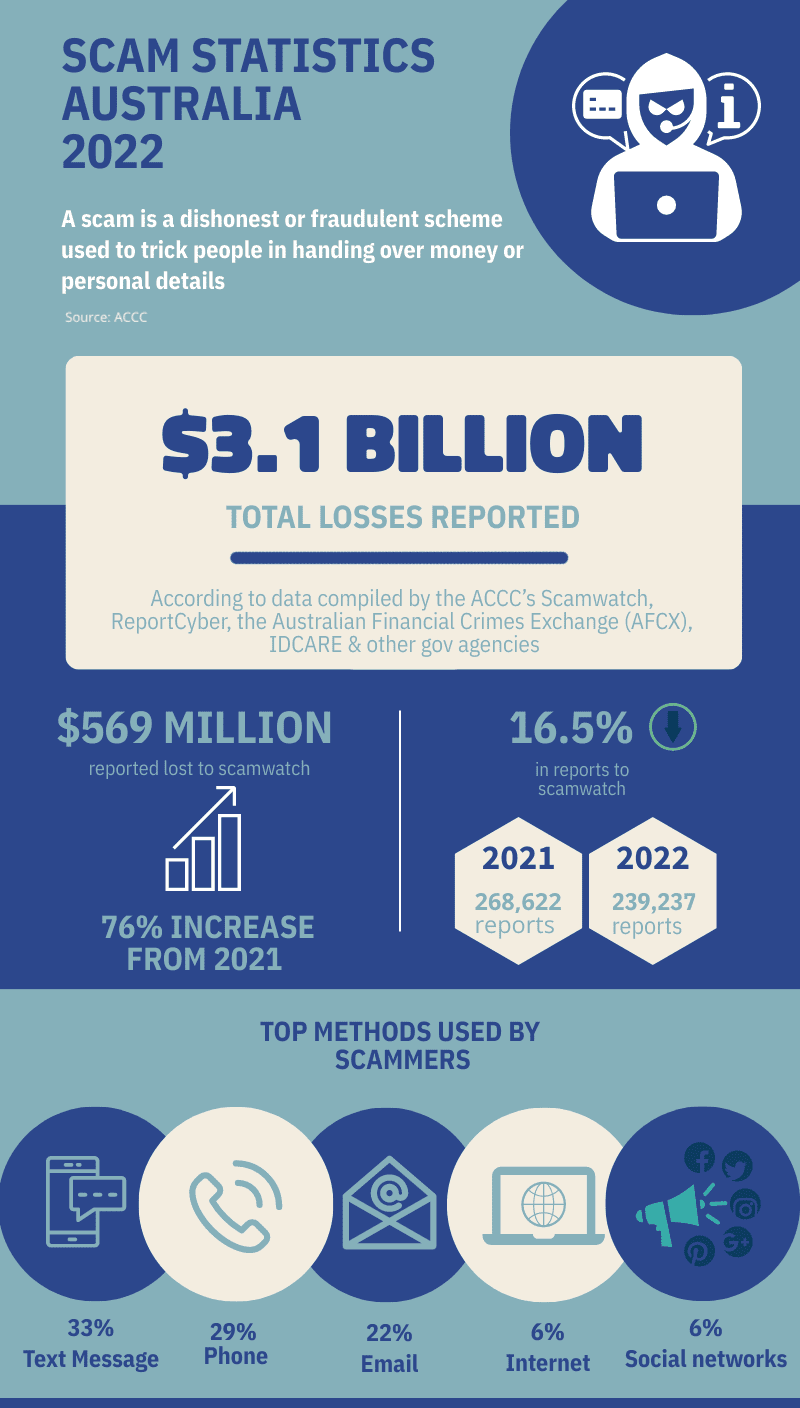

Latest figures in the Australian Competition and Consumer Commission (ACCC) Targeting Scams report, which analysed over 500,000 scam reports from various agencies, have prompted urgent calls for the Australian Federal Government to take action. The report reveals Australians fell victim to scams at an unprecedented level in 2022, losing an $3.1 billion, marking an 80% increase from the total losses recorded in the previous year.

Despite the rise in financial losses, Scamwatch saw a 16.5 per cent decrease in scam reports, with the number of reports dropping from 268,622 in 2021 to 239,237 in 2022.

Despite the fewer reports, Scamwatch recorded a total of $569 million in financial losses, which is a 76 per cent increase from the losses reported in 2021, making the average lost per victim almost $20,000.

ACCC deputy chairperson Catriona Lowe said in a media release the price consumers pay when they fall victim to a scam is much more than what has been recorded on the annual report and has called for action against the cunning strategies used by fraudsters.

“Australians lost more money to scams than ever before in 2022, but the true cost of scams is much more than a dollar figure as they also cause emotional distress to victims, their families and businesses,” Ms Lowe said.

“As scammers become increasingly sophisticated in their tactics, it is clear a coordinated response across government, law enforcement and the private sector is essential to combat scams more effectively.”

The new strategies employed by scammers involve the fraudulent use of official phone numbers, email addresses, and websites belonging to legitimate organisations and businesses, making scams increasingly difficult for consumers to detect.

A Sutherland Shire-based couple, who wish to remain anonymous, narrowly dodged a sophisticated scam after receiving an official-looking email from their ‘builder’ with an invoice for their next instalment.

“We received an email from our builder’s actual email address, saying that our next instalment of $300k was due. It was the exact amount of our instalments and it was a routine email,” the couple said.

“The only thing that was different was that they said they had changed their bank details and even though I thought it was a bit strange, the email looked so legitimate that we didn’t really question it or consider the fact that it could’ve been a scam.”

They said life’s distractions caused the email to slip their mind, and it wasn’t until they saw the builder in the afternoon that they were reminded of it.

“I realised when I saw the builder that I had forgotten to transfer the money and out of curiosity I asked why he had changed his account details. He had absolutely no idea what I was talking about and later found out that it was a scam,” they said.

However, statistics show not everyone is so lucky and as traditional bank transfers continue to be the most frequently used payment method for scammers, the ACCC is urging the Australian federal government to mandate the implementation of technology that verifies the name and account details before authorising any fund transfer across all banks, ensuring they match the intended recipient. The ACCC believe that this strategy could save Australians approximately $420 million a year.

Photograph: Dominic Lipinski/PA via The Guardian