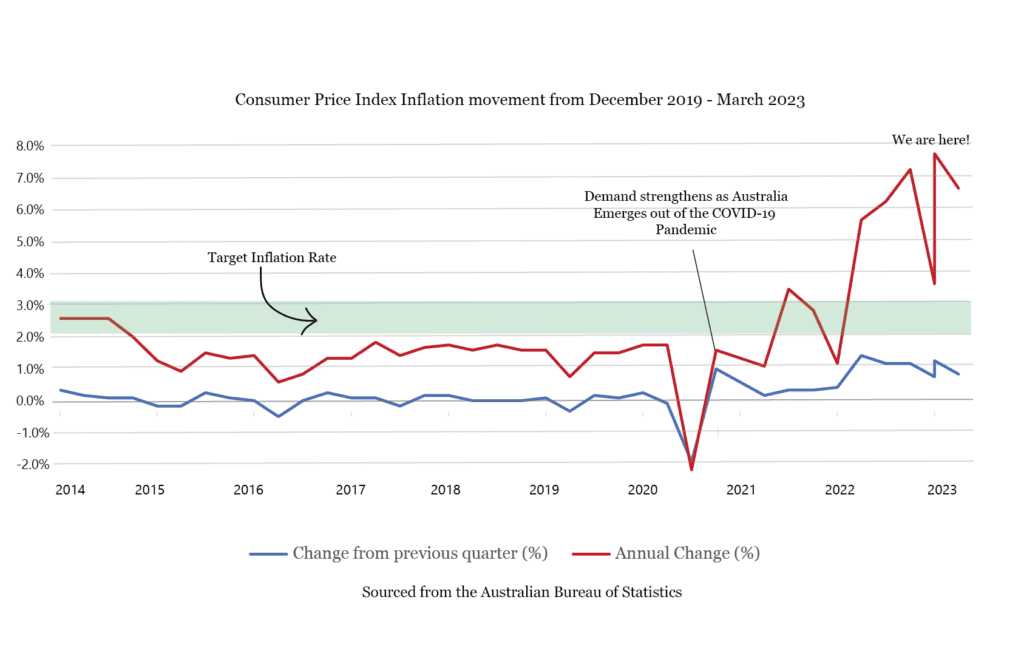

The student HELP debt is set to increase by 7.1 per cent on June 1, making it the biggest rise in 40 years.

Students will incur an increase of about $1760 to their HECS debt due to inflation.

Practicing accountant, Jarrod Rogers said that early repayments are particularly attractive this year as the indexation rate is higher than savings and mortgage rates.

“High inflation is going to make it tough for some people to ever clear their debt, even those on average wages with fairly moderate debts,” Mr Rogers said.

A person with a $20,000 HELP debt will have $1,420 added to their debt on June 1, meaning an early repayment of $5,000 would result in a saving of $355.

The average student HELP loan of $24,771 will be increase by $1760, and by $2840 for an additional half a million graduates with debts of $40,00 or more.

Students earning less than $48,361 will have no minimum required payment towards their HELP debt, however those earning up to $60,000 will have an automatic payment of $1500 deducted.

These HELP repayments are deducted after the students lodge tax return, with options to submit debt payments on a weekly or monthly basis.

After completing a tertiary degree and entering the workforce, graduating students are expecting to earn certain amounts within their field.

HELP repayments will then be mandatorily paid through the students income.

“High inflation is going to make it tough for some people to ever clear their debt, even those on average wages with fairly moderate debts,” Mr Rogers said.

A Wollongong University student, who wished not to be named, expressed their thoughts on the HELP repayments.

“After hearing the news, I realised that I have enough in my savings to start paying back my debt before the indexations applied in June. However, knowing some of my peers’ financial situations, this isn’t the case for most people.” said the UOW student.

Mr Rogers said a person on a low income may never have to repay the debt, although it is possible that a future government could change the current rules in relation to HECS debt.

Credit: Sienna Wallace, Bianca White.