People with HECS-Help loans have been encouraged to make payments by today to avoid an indexation rise on June 1.

The Australian Tax Office has advised that the loans will increase by 7.1 per cent in accordance with the Consumer Price Index (CPI), a month before the end of the financial year.

Despite much backlash over the high increase, the HELP system will continue to be subject to indexation, said Treasurer Jim Chalmers in a press conference in April.

“This indexation that happens around the middle of the year, every year, happens regardless of who is in office…that is how the system works,” he said.

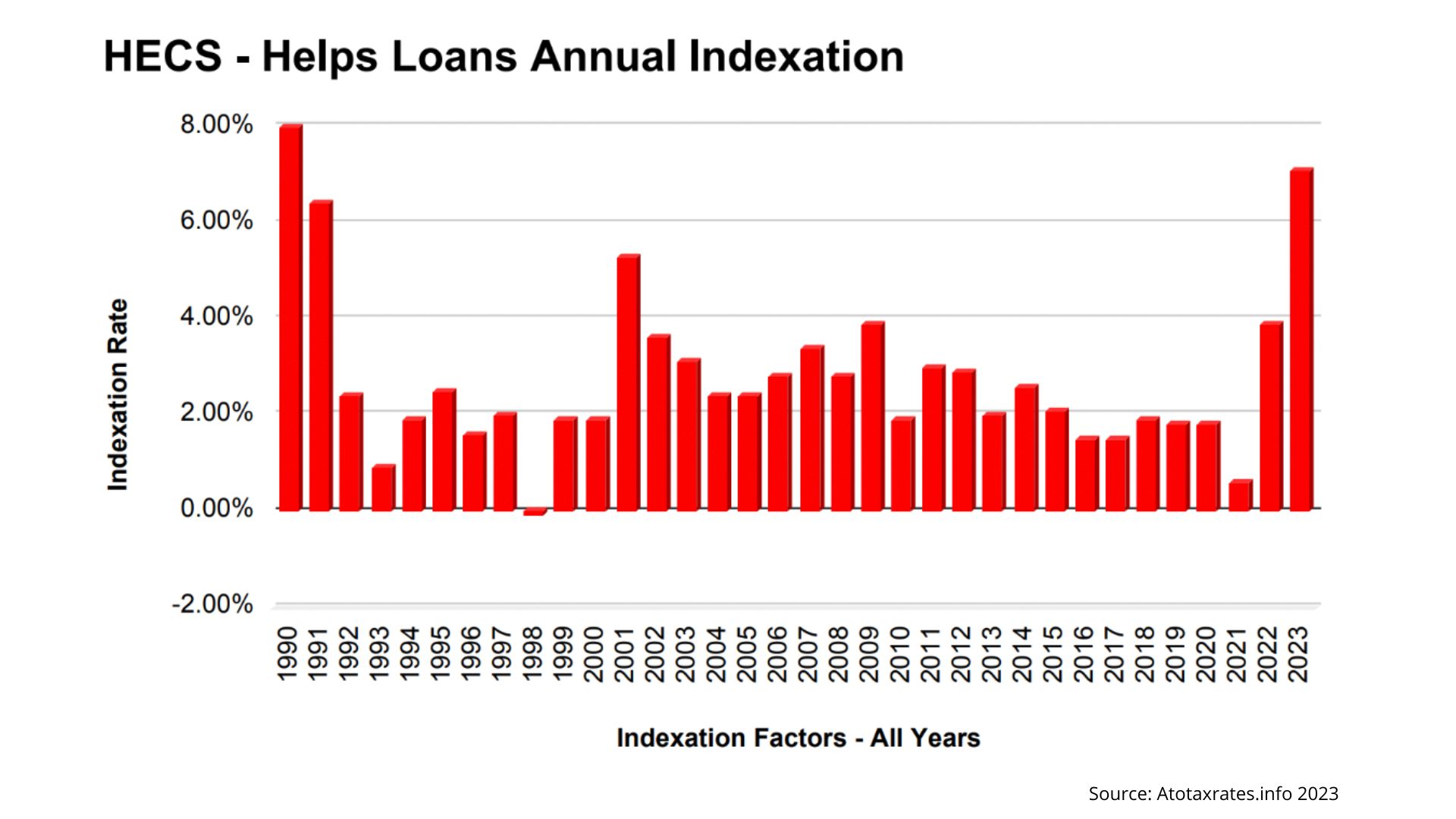

The latest increase is set to be the highest rise in over two decades, when indexation was at 8% in 1990.

The CPI is forecast to be around 5 per cent this year and next, and is expected to subside to around 3 per cent by June 2025.

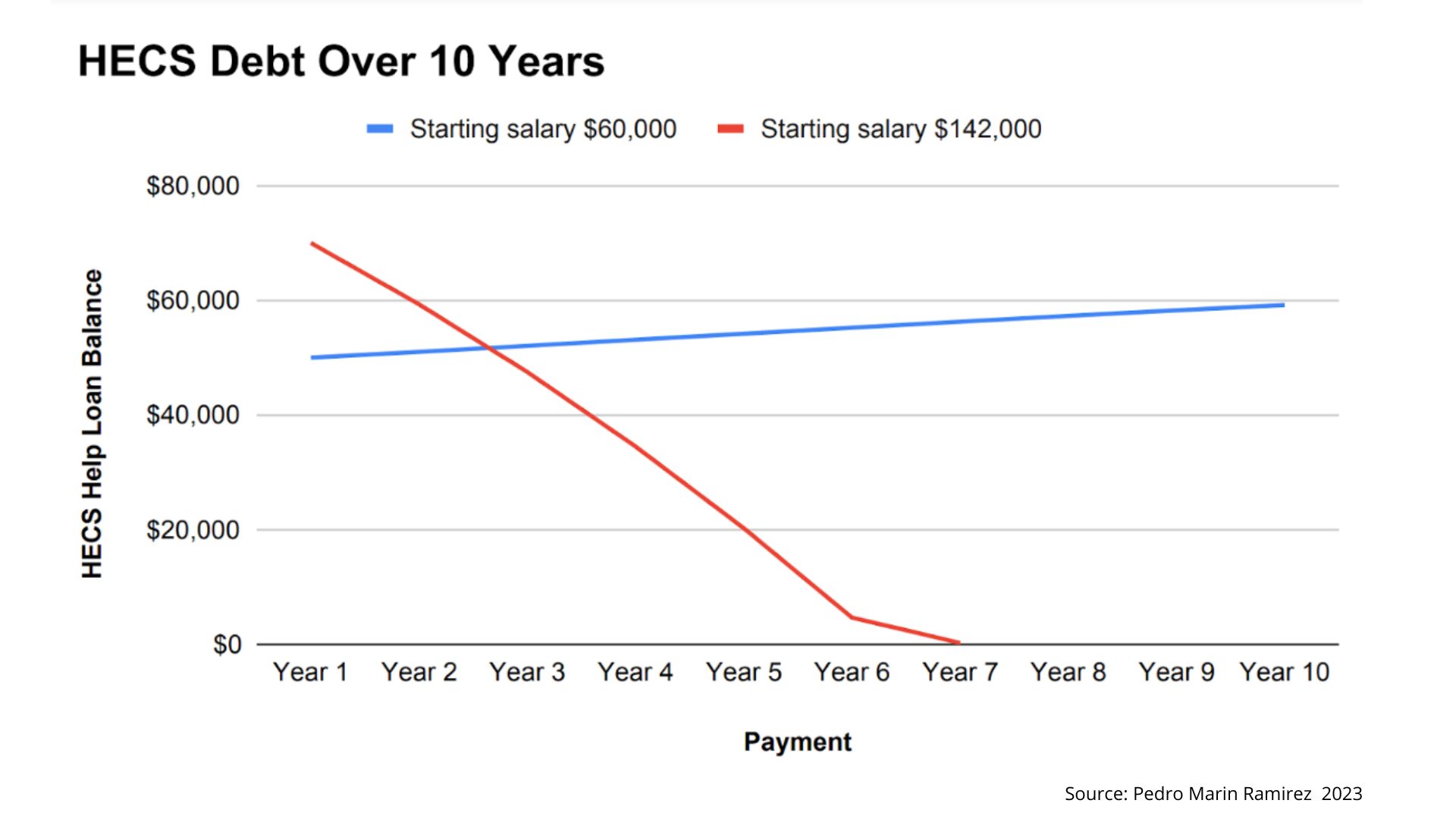

Financial advisor, Pedro Marin Ramirez told the ABC that if CPI and subsequently indexation do not decrease, it could result in stagnant, or even rising HECS-HELP debt, despite regular payments being made.

As of 2023, the average starting salary of a graduate is $60,000. If indexation increases at a rate of 5 percent over ten years, a graduate making regular payments would see their HECS-HELP increase by almost $10,000 over ten years.

The ATO has advised urgency to ensure there is time to process the payment with no fees incurred due to administration procedures. However, there are mixed opinions on whether it would be beneficial.

Financial planner with Prosperity Wealth Advisors, Rocky Johnston suggests young people are better off investing their money in other places rather than rushing to clear their student debt.

“Whether it be putting money in your super, investing, or buying that first home… over the long run might provide a [greater] benefit to your life than just trying to save an extra $1000 by paying off your HECS a little bit earlier,” Mr Johnston told the Guardian.

Senior financial planner at MBA Financial Strategists, Mark Borg disagreed and told the Australian Associated Press that young Australians would essentially make money by making a payment.

“If I was to earn seven per cent after tax, I’d have to earn a bit over 10 per cent, pay my 30 cents on the dollar tax and be left with seven per cent,” Mr Borg said.

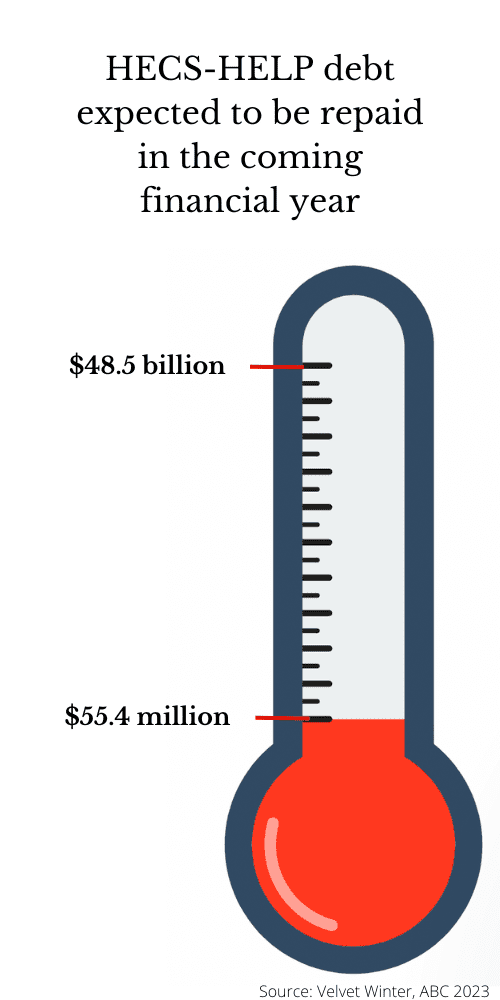

Australians overall have $48.5 billion in HECS-HELP debt with only just over $55 million expected to be paid over 2023/24 financial year.

Credit: Emilia Campbell, Zara Koschitzke