Housing affordability and availability in Australia has continued to take a nose-dive but may see some relief in the Federal Government’s budget with a $14.6 million cost of living plan to create more sustainable housing.

The ‘State of the Nation’s Housing’ document released in April by the National Housing Finance and Investment Corporation (NHFIC) has detailed a sharp decline in housing affordability and availability across the country.

Treasurer Jim Chalmers’ budget announced on Tuesday that the plan aimed to make housing more accessible for struggling Australians, who have been hit hard by the rental crisis and rise in mortgage interest rates.

“For too long, secure, affordable housing has been out of reach for too many Australians,” Mr Chalmers said.

The ‘Commonwealth Rent Assistance’ program is set to increase by 15 per cent from September and is expected to cost $2.7 billion over five years. The government calling it the largest increase in more than three decades.

The inflation rate is currently sitting at 7 per cent and has had a large impact on housing and utilities, with wages increasing by just 3.3 per cent in 2022.

A new report based on CoreLogic data suggests the national median rents climbed from $440 per week in January 2020 to $577 per week in April 2023.

Source: Australian Bureau of Statistics

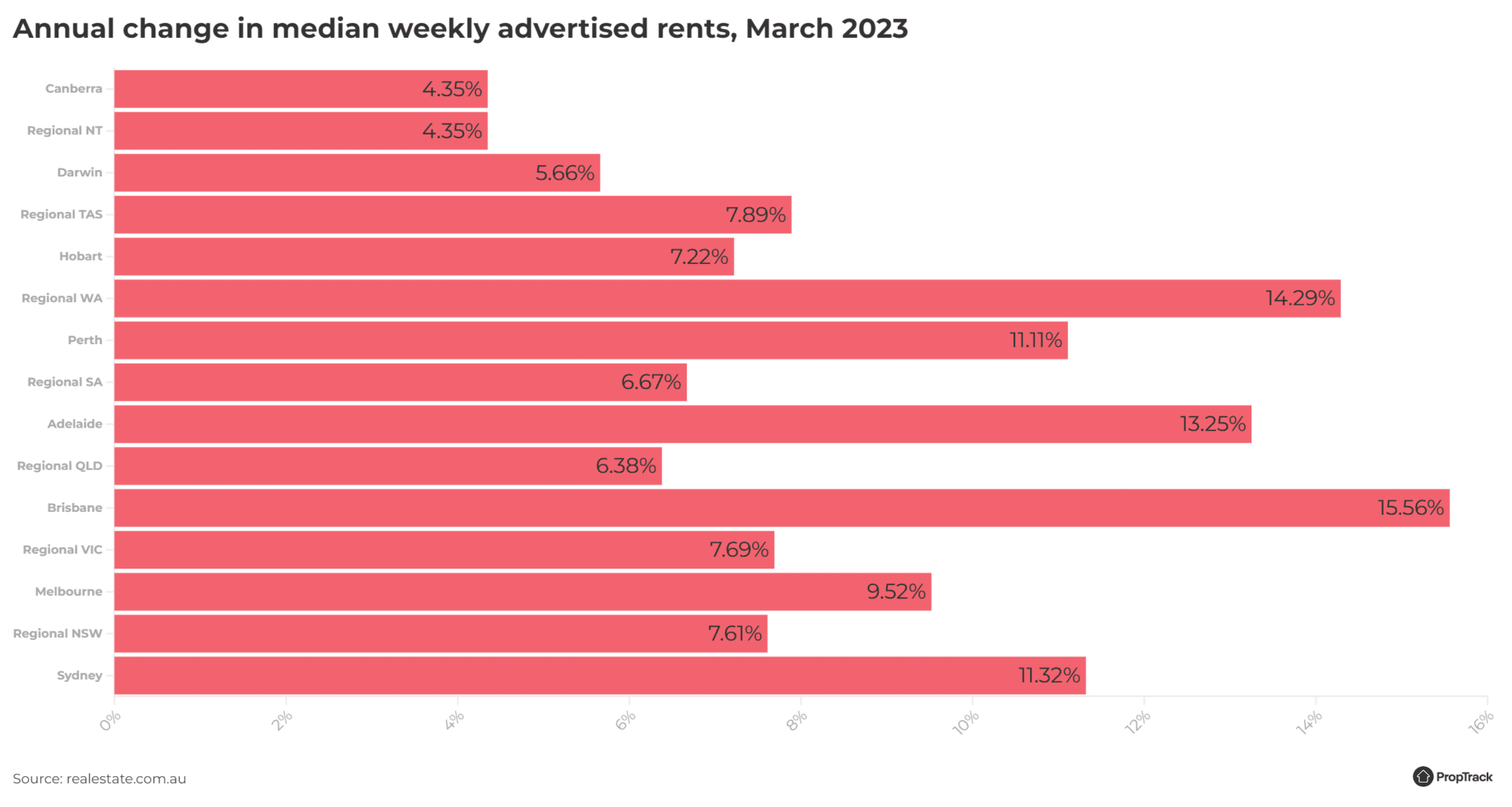

The report for the March 2023 quarter by realestate.com has found that each capital city and regional area recorded an increase in advertised rents over the year to March 2023.

Brisbane (15.6 per cent), regional WA (14.3 per cent) and Adelaide (13.3 per cent) had the largest increases, with regional NT (4.3 per cent), Canberra (4.3 per cent) and regional Queensland (6.4 per cent) seeing the smallest increases.

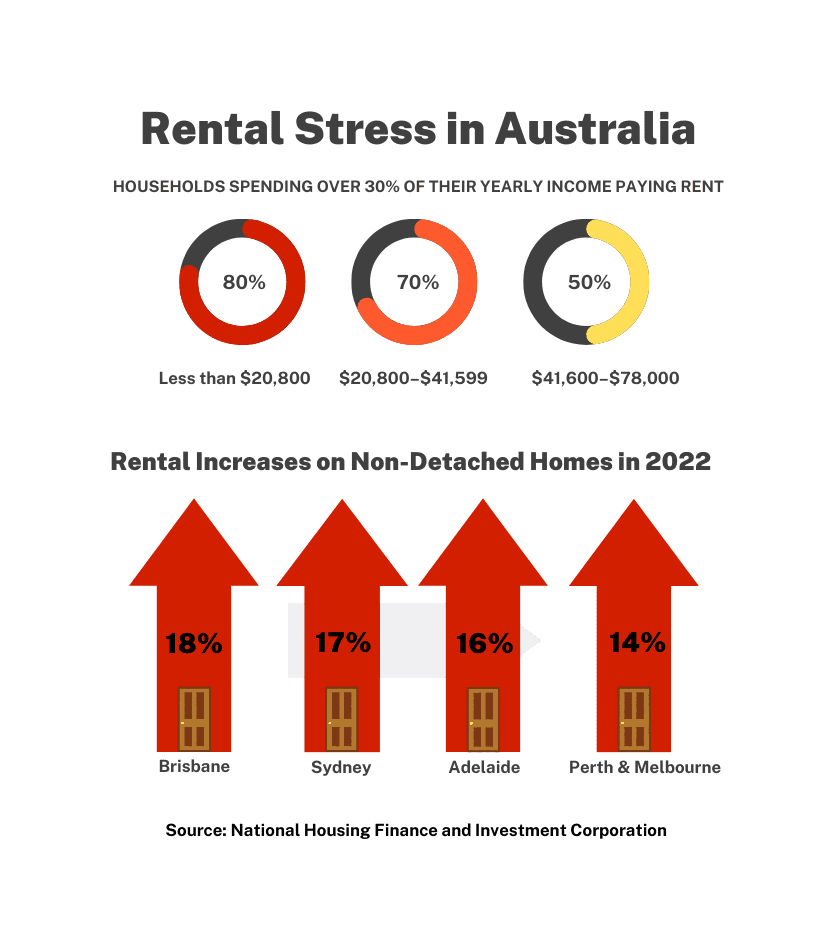

A NHFIC report estimates 331,100 households are in “significant rental stress.”

Rental stress is defined when households are spending more than 30 per cent of their income on rent.

The NHFIC survey found no homes that a single person on Youth Allowance could afford, four houses for a single person on JobSeeker, and 99 that a couple both receiving JobSeeker with two young children could afford.

For a couple on the aged pension, there were 508 rental affordable properties and 66 homes – 0.1 per cent of those advertised—were in the price range for a single adult receiving the disability support pension.

In a recent report by SGS Economics and Planning, 42 per cent of all low-income households are paying more than 30 per cent of their income on housing.

In a media release by Savvy Finance, a spokesperson said that 640,000 Australian households are under housing stress or homeless, as of February this year and that number is set to grow to almost one million households by 2041.

Additional reporting: Russ Haylock.